Tesla Loses Market Lead: How the EV Pioneer Is Facing Its Toughest Competition Yet

For more than a decade, Tesla symbolized the future of electric vehicles (EVs). It was the undisputed leader—technologically, culturally, and financially. Tesla didn’t just sell cars; it reshaped how the world thought about mobility, energy, and software-driven vehicles.

But in 2025, the narrative has shifted.

Tesla is no longer the clear market leader it once was. While it remains one of the most influential EV companies in the world, its dominance is being challenged—sometimes overtaken—by aggressive global competitors, changing consumer expectations, and a rapidly maturing EV ecosystem.

This article explores why Tesla is losing market leadership, what factors are driving this shift, and what it means for the future of the electric vehicle industry.

Tesla’s Rise: How It Became the EV Benchmark

Tesla’s early success was not accidental. It combined several breakthroughs that legacy automakers struggled to match:

-

Long-range lithium-ion battery packs

-

Over-the-air (OTA) software updates

-

A vertically integrated manufacturing model

-

A strong brand built around innovation and sustainability

Under the leadership of Elon Musk, Tesla positioned itself not as a car company, but as a technology company that happened to build vehicles. Models like the Model S, Model 3, and Model Y set new standards for EV performance and range.

For years, competitors were simply playing catch-up.

The Market Has Caught Up—and Then Some

The biggest reason Tesla is losing its market lead is simple: the competition has arrived in full force.

China’s EV Giants Are Winning on Volume

Chinese manufacturers, especially BYD, have surpassed Tesla in global EV sales volume. BYD benefits from:

-

Massive domestic demand

-

Strong government support

-

Vertical integration in batteries and components

-

Lower manufacturing costs

While Tesla still leads in brand recognition globally, BYD and other Chinese automakers are winning where it matters most: scale and affordability.

Legacy Automakers Have Learned the EV Game

Traditional automakers like Volkswagen, Hyundai, and General Motors have invested tens of billions into EV platforms.

Unlike Tesla, they bring:

-

Decades of supply-chain expertise

-

Established service networks

-

Experience with quality control at scale

Tesla’s early technological lead has narrowed significantly, especially in areas like build quality, interior comfort, and reliability.

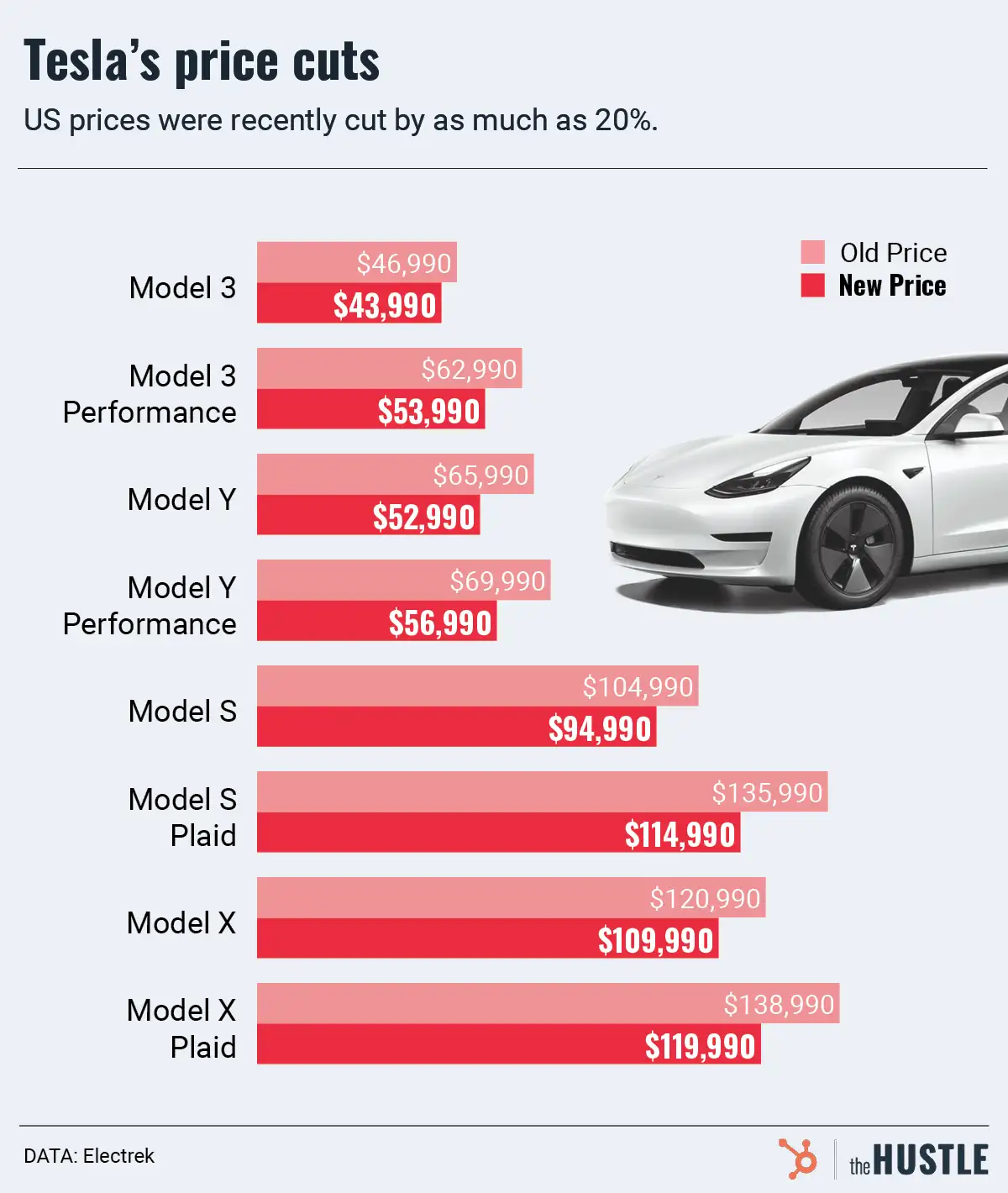

Price Wars Are Eroding Tesla’s Advantage

To defend its market share, Tesla has repeatedly slashed prices across multiple regions. While this strategy has boosted short-term sales, it has also created new problems:

-

Shrinking profit margins

-

Brand perception shifting from “premium tech” to “discount EV”

-

Increased pressure on manufacturing efficiency

Tesla once enjoyed industry-leading margins. Today, those margins are under constant threat as competitors match or undercut Tesla’s pricing with comparable features.

Innovation Slowdown: Perception vs Reality

Tesla is still innovating—but the pace feels slower relative to expectations it set for itself.

Where Tesla Still Leads

-

Battery efficiency and energy management

-

Software-first vehicle architecture

-

Autonomous driving research

Where It’s Falling Behind

-

Model refresh cycles

-

Interior refinement

-

Affordable mass-market EV launches

The long-promised “next-generation affordable Tesla” has faced delays, allowing competitors to capture price-sensitive segments first.

Full Self-Driving: A Double-Edged Sword

Tesla’s Full Self-Driving (FSD) system remains one of its most ambitious projects. However, it has become a strategic liability as much as a strength.

Challenges include:

-

Regulatory scrutiny across multiple countries

-

Consumer confusion over the term “Full Self-Driving”

-

Slow real-world autonomy approval

Meanwhile, companies like Waymo are deploying fully autonomous services in controlled environments, shifting public perception of who is actually leading autonomy.

Regional Challenges: Tesla’s Uneven Global Performance

China: A Brutal Battlefield

China is the world’s largest EV market—and Tesla’s toughest challenge. Domestic brands offer:

-

Lower prices

-

Localized features

-

Faster model refreshes

Tesla is no longer the aspirational default choice for Chinese buyers.

Europe: Regulation and Choice

European consumers now have dozens of EV options across price segments. Stringent regulations, combined with strong local brands, have diluted Tesla’s once-unique appeal.

Brand Fatigue and Leadership Distractions

Tesla’s brand has always been closely tied to Elon Musk’s public persona. In recent years, that association has become more complex.

-

Political controversies

-

Focus diverted to other ventures

-

Increased scrutiny from investors

While Musk remains a visionary leader, markets are increasingly asking whether Tesla needs operational focus over spectacle.

Tesla’s Strengths Are Still Real

Despite losing its clear market lead, Tesla is far from finished.

What Tesla Still Does Better Than Most

-

Best-in-class charging ecosystem (Superchargers)

-

Software updates that improve vehicles post-purchase

-

Strong energy business (solar, batteries, grid storage)

-

Global brand recognition

Tesla’s integration of vehicles, energy storage, and AI gives it a broader strategic footprint than many competitors.

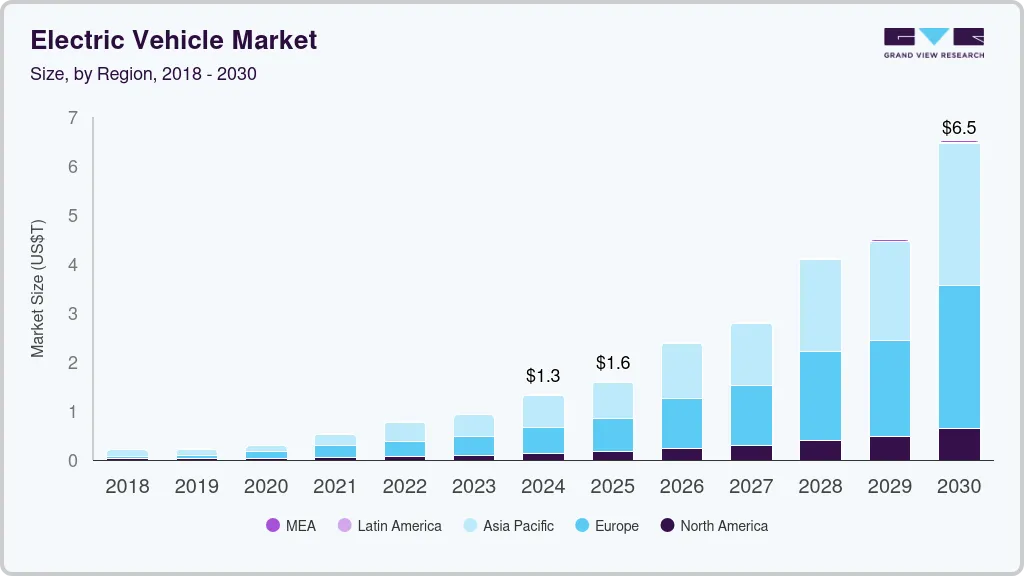

The EV Market Has Changed—Forever

The most important context: Tesla isn’t necessarily failing—the market is maturing.

When Tesla started, EVs were niche. Today:

-

EVs are mainstream

-

Competition is intense

-

Innovation is distributed across dozens of players

In a mature market, dominance gives way to fragmentation and specialization.

What Tesla Must Do to Regain Momentum

To reclaim leadership—not just survive—Tesla may need to:

-

Deliver a truly affordable mass-market EV

-

Refresh existing models more aggressively

-

Clarify autonomy timelines and capabilities

-

Improve build quality consistency

-

Balance innovation with execution

The company still has the resources, talent, and technology to do all of the above.

Conclusion: From Lone Pioneer to One of Many Leaders

“Tesla Loses Market Lead” doesn’t mean Tesla is obsolete. It means the EV revolution it sparked has succeeded—so well that it no longer belongs to one company.

Tesla is transitioning from dominant disruptor to competitive incumbent. That shift is uncomfortable, but not fatal.

In the next phase of the electric vehicle era, leadership will be defined not by who arrived first—but by who adapts fastest.

And if history has shown anything, it’s that Tesla should never be counted out too early ⚡

For quick updates, follow our whatsapp –https://whatsapp.com/channel/0029VbAabEC11ulGy0ZwRi3j

https://bitsofall.com/amazon-warehouse-robots-ai-learning-diverse-products/

https://bitsofall.com/amazon-50-billion-ai-infrastructure-us-government/

Early Disease Diagnosis App: How AI-Powered Health Apps Are Transforming Preventive Healthcare