Massive Economic Upside from AI Adoption

Executive summary

Artificial intelligence (AI) is shifting from a promising technology to a broad general-purpose platform that can lift productivity across nearly every industry. Unlike past waves of automation that were bounded to specific machines or workflows, contemporary AI systems—especially those combining predictive models, large language models (LLMs), computer vision, and autonomous decision-making—operate in the spaces where work is information-heavy, collaborative, and customer-facing. That’s a large share of modern GDP. The economic upside is “massive” not just because AI can replace discrete tasks, but because it compounds improvements across value chains: better demand forecasts reduce waste; smarter design compresses time-to-market; adaptive service boosts conversion and retention; and autonomous optimization trims energy, logistics, and inventory costs. Layer in entirely new products and business models, and AI becomes a structural tailwind for growth.

This article maps the mechanisms through which AI drives macroeconomic gains, quantifies where value pools are likely to emerge, explains adoption pathways for firms and public institutions, and addresses the frictions—skills, governance, and infrastructure—that must be solved to realize the full upside. The short version: AI’s impact will be biggest where organizations re-architect processes end-to-end, not where they bolt tools onto legacy workflows.

Why AI’s economic impact is different (and bigger) this time

1) It is a software layer, not a single machine. AI can be embedded everywhere data flows: email, CRMs, ERPs, CAD tools, EHRs, factory PLCs, and payment rails. That ubiquity means gains no longer require capex-heavy hardware cycles alone; they come from models and agents that ride existing digital infrastructure.

2) It improves with scale and feedback. Model performance, tool-use reliability, and agent autonomy increase with more data and reinforcement. In economic terms, you get learning curves that spill over across functions and business units—returns that look superlinear rather than linear.

3) It complements both brains and brawn. A century of automation mostly replaced physical tasks. AI enhances judgment, writing, research, planning, classification, and coordination—the “cognitive glue” of organizations. When coordination costs fall, firms unlock bigger spans of control and faster decision cycles.

4) It creates new markets. Generative design, synthetic data, personalized media, on-device copilots, and AI-native services (autonomous customer support, AI tutoring, adaptive healthcare triage) aren’t just cost savers; they’re revenue creators that expand the frontier of what’s possible.

The productivity mechanics: where the percentage points come from

Think of AI’s upside as the sum of four reinforcing levers:

-

Labor productivity – Automating routine tasks and accelerating expert workflows.

-

Drafting, summarizing, translating, spec generation, requirements-to-code, test creation, and root-cause analysis become “push-button” steps.

-

Knowledge workers spend more time on synthesis, stakeholder alignment, and creative problem-solving.

-

Capital productivity – Higher utilization and yield on assets.

-

Predictive maintenance reduces downtime.

-

AI-based scheduling and routing increase throughput in logistics, manufacturing, and cloud compute.

-

Generative design lowers material costs and accelerates iteration cycles.

-

Total factor productivity – Better matching of inputs to outputs.

-

Dynamic pricing and demand sensing cut excess inventory.

-

Supply risk models reconfigure sourcing before shocks bite.

-

Autonomous experimentation (multi-armed bandits, reinforcement learning) tunes offers and experiences in real time.

-

Innovation velocity – New products and services with higher margins.

-

AI-native offerings (e.g., personalized education, virtual R&D assistants, patient-specific care plans) deliver value that did not exist or was too expensive to provide.

A simple way to see the compounding: imagine a business with 10% operating margin. A 5% revenue lift from personalization and a 5% cost reduction from process automation do not merely add; they multiply (1.05 revenue × 0.95 cost), often producing double-digit profit improvements that can be reinvested into more AI, igniting a flywheel.

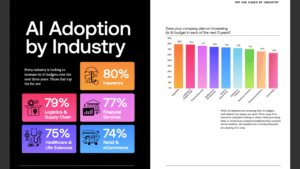

Sector-by-sector value pools

Healthcare

-

Upside: Earlier detection, faster documentation, better triage, and precision care pathways.

-

Mechanisms: AI scribes reduce clinician administrative time; imaging models flag abnormalities; population health models target interventions; drug discovery platforms compress lead times.

-

Outcomes: Shorter patient waiting times, fewer errors, and shift from volume to value-based care. Economic gains come from reducing waste (duplicative tests, readmissions) and improving labor utilization in high-shortage fields.

Manufacturing & industrials

-

Upside: Higher overall equipment effectiveness (OEE), lower scrap, faster design cycles.

-

Mechanisms: Vision models for quality control, predictive maintenance for critical assets, AI-driven scheduling, and generative design for lighter components.

-

Outcomes: Shorter cycle times, smaller batch sizes at similar cost (mass customization), and resilience to supply shocks via scenario planning agents.

Financial services

-

Upside: Basis-point improvements cascade into large absolute dollars.

-

Mechanisms: Fraud detection with fewer false positives, AI underwriting and risk scoring, automated KYC/AML with explainable pipelines, and personalized advice at scale.

-

Outcomes: Better loss ratios, higher cross-sell and retention, and leaner back offices.

Retail & e-commerce

-

Upside: Demand forecasting accuracy translates directly to gross margin and cash conversion cycle gains.

-

Mechanisms: AI for assortment, pricing, and content generation; agents for vendor negotiation; smart routing for “next-best offer.”

-

Outcomes: Lower markdowns, higher conversion, and improved working capital.

Software & IT services

-

Upside: Code generation and test automation shrink cycle times and defects.

-

Mechanisms: Requirements-to-code, test synthesis, AI pair programming, log analysis copilots, and autonomous incident response.

-

Outcomes: Faster release trains, better reliability, and more features per engineer-hour—expanding the feasible product frontier.

Energy & utilities

-

Upside: Load forecasting, predictive maintenance, and grid optimization reduce costs and emissions.

-

Mechanisms: Asset health models for turbines and transformers, DER (distributed energy resource) orchestration, and AI-enabled demand response.

-

Outcomes: Higher capacity factors, fewer outages, and better integration of renewables.

Public sector & education

-

Upside: Service delivery at lower cost; improved compliance and analytics.

-

Mechanisms: AI assistants for case workers, automated benefits adjudication, AI tutors that personalize learning trajectories.

-

Outcomes: Higher citizen satisfaction, reduced backlogs, and better educational attainment per dollar spent.

Timelines and adoption curves

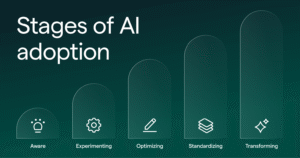

AI adoption tends to follow an S-curve: slow proof-of-concept, rapid scaling, then saturation. Three patterns matter:

-

Tool-first to workflow-first. Early adoption centers on copilots for individuals. The big step-change arrives when firms restructure workflows so that AI is the “first touch” and humans approve or escalate.

-

Horizontal to vertical specialization. General models get fine-tuned with domain data and tools (retrieval, structured APIs, simulators). This is when error rates fall below thresholds required for regulated or high-stakes tasks.

-

Centralized to federated. As privacy, latency, and cost pressures rise, inference shifts closer to the edge (on-device, on-prem), while central system-of-records maintain governance and auditability.

Realizing the macro upside is less about a single breakthrough and more about thousands of these curve crossings across sectors and geographies.

The firm-level playbook: how to capture the upside

1) Start with a P&L lens. Map where value is created and destroyed—gross margin, SG&A, inventory turns, churn, time-to-revenue—and target AI to shift those lines. Avoid “pilot purgatory” by tying each use case to a metric the CFO tracks.

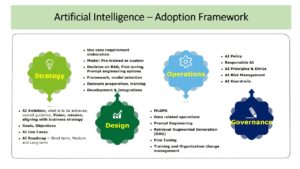

2) Build an AI operating model.

-

Data: Consolidate critical datasets with clear owners, quality SLAs, and lineage.

-

Platforms: Standardize on a small set of model providers and MLOps stacks.

-

Guardrails: Define risk tiers, approval flows, red-teaming, and fallback plans.

-

People: A central AI platform team (“enablement”) plus embedded AI engineers in each business unit.

3) Re-architect work. Change job designs to treat AI as a collaborator. For example, in support centers, move from “agent handles everything” to “AI drafts + agent verifies,” plus continuous learning from resolutions.

4) Instrument for learning. Capture prompts, outcomes, feedback loops, and business impact. Use experimentation frameworks (A/B and bandits) for each workflow to quantify lift.

5) Balance build vs buy. Use off-the-shelf copilots for common tasks, fine-tune for domain language and tools, and build bespoke agents when workflows are unique sources of advantage.

6) Iterate on safety and trust. Invest in monitoring for drift, hallucination, bias, and security. Establish human-in-the-loop for sensitive decisions, and publish model cards/policies to internal stakeholders.

Quantifying the upside: a simple scenario model

Consider a mid-market company with $1B in annual revenue, 12% operating margin, and $400M in people-related costs:

-

Revenue lift: Personalized recommendations, better marketing creative, and sales assist drive a conservative 3–6% increase in top line. Take 4% midpoint → +$40M.

-

Cost reduction: Process automation (AP/AR, support, QA, procurement) and fewer rework loops cut 5–8% of operating costs excluding COGS. Suppose $200M of relevant costs × 6% → +$12M.

-

COGS improvement: Forecasting and waste reduction save 1–3% on $600M COGS → 2% midpoint = +$12M.

-

Capex deferral & utilization: Better asset scheduling reduces depreciation burden effectively by 1% of revenue through higher utilization → +$10M equivalent.

Combined impact: roughly +$74M to operating profit on a $120M baseline—over 60% uplift—with a payback period under 12 months if initial AI program costs $10–20M. The exact numbers vary, but the structure holds broadly across sectors.

Labor market effects: job disruption vs. job expansion

It’s true: AI automates tasks that many roles perform today. But the economic upside doesn’t require a net reduction in employment. Three dynamics matter:

-

Task reallocation: AI handles drafting, searching, classifying, and reconciling; humans shift to judgment, stakeholder work, and creativity. The same headcount can support more customers or products.

-

Demand expansion: Lower costs and better experiences expand markets. More tutoring leads to more learners; faster software development produces more features; better healthcare access increases service volume.

-

New occupations: Prompt engineers gave way to “workflow architects,” “AI product owners,” and “model risk officers.” As tools mature, the center of gravity moves to domain experts who can specify, verify, and improve AI-enabled processes.

For countries with aging populations and chronic skill shortages (healthcare, skilled trades, cybersecurity), AI’s augmentation may be the only scalable way to sustain growth without importing labor.

SMEs and the long tail: democratizing advantage

Historically, only large firms could field analytics teams and proprietary data lakes. AI flips that script. With cloud-based models, plug-in copilots, and domain-specific SaaS, small and medium enterprises can rent world-class capabilities:

-

Sales & marketing: Auto-generated proposals, SEO content, and multilingual outreach expand reach without agencies.

-

Back office: Automated invoicing, collections, and compliance reduce financial friction.

-

Product: Low-code and AI-assisted development let small teams ship features once reserved for deep-pocketed competitors.

The macro effect is stronger competition, faster diffusion of best practices, and a thicker “middle” of productive firms—an important driver of aggregate productivity.

Emerging and developing economies: leapfrogging potential

AI lets late adopters skip intermediate stages of development:

-

Education: AI tutors and teacher-assist tools raise learning outcomes where teacher-student ratios are high.

-

Healthcare: Telemedicine with AI triage extends scarce specialists.

-

Agriculture: Yield optimization via imagery and weather nowcasts improves food security.

-

Government services: Digital assistants streamline licensing, benefits, and tax administration, widening the revenue base and reducing leakage.

The key is affordable access (connectivity, devices), local-language models, and public-private partnerships to align incentives. When those align, AI can compress decades of institutional learning into a few years.

Enablers: what must be in place

1) Data foundations. High-quality, well-governed, and ethically sourced data are table stakes. Invest in metadata, lineage, access control, and synthetic data for privacy-preserving training.

2) Infrastructure. Capacity for training and inference (GPUs, CPUs, accelerators), efficient orchestration, and edge capabilities for low-latency use cases. Energy-efficient data centers and heat reuse schemes matter to cost curves and sustainability.

3) Talent & literacy. Beyond machine learning engineers, organizations need product managers who translate business problems into AI workflows, and frontline staff trained to supervise and improve AI outputs.

4) Governance and safety. Model risk management, audit trails, content filtering, and red-teaming should scale with usage. Clear lines for human oversight in high-stakes decisions are non-negotiable.

5) Interoperability. Open standards for tools, APIs, and evaluation enable switching and multi-model strategies—vital to avoid lock-in and to route tasks to the most capable model per dollar.

Risks to manage (without killing the upside)

-

Hallucinations and reliability. Mitigate with retrieval-augmented generation, constrained decoding, tool use, and structured output formats with schema validation.

-

Security and data leakage. Use tenant isolation, policy enforcement, and prompt/response filtering; prefer on-prem or VPC setups for sensitive workloads.

-

Bias and fairness. Build representative datasets, measure outcomes across groups, and include domain experts in evaluation.

-

Regulatory compliance. Document data sources and model behavior; implement human-in-the-loop for regulated decisions (credit, hiring, healthcare).

-

Concentration of compute. Encourage multi-cloud and regional capacity; explore efficient models and distillation to keep cost curves accessible.

Handled well, these risks become manageable operational disciplines rather than barriers.

Policy pathways to amplify the upside

1) National AI infrastructure. Co-invest in neutral compute and data platforms accessible to startups, SMEs, researchers, and public agencies. Subsidize usage for education, health, and civic applications.

2) Skills acceleration. Fund short, stackable credentials that layer AI literacy onto existing professions (nursing, law, construction, agriculture), not just computer science tracks.

3) Data commons and safe sharing. Create sectoral data trusts (health, mobility, climate) with privacy-preserving access, standardized governance, and clear liability regimes.

4) Outcome-based regulation. Focus on measurable harms and safety thresholds rather than freezing fast-evolving technical means. Provide regulatory sandboxes for innovation in high-impact sectors.

5) Procurement as a lever. Government is a large buyer. Mandate open interfaces, publish evaluations, and reward solutions that prove efficiency and equity gains, catalyzing private markets.

Case vignette: an AI-first customer operations redesign

A telecom operator with 15 million subscribers re-architects support:

-

Before: 6,000 agents, 70% of contacts via phone, average handle time 7 minutes, first-contact resolution 62%.

-

After AI redesign:

-

An AI concierge triages requests, solves 40% end-to-end with tool use (account lookups, plan changes, diagnostics).

-

For escalations, AI drafts responses and proposes actions; agents verify.

-

A feedback loop updates playbooks weekly; a risk engine flags edge cases for supervisors.

-

-

Impact (12 months): Call volume down 35%, FCR up to 81%, churn falls 80 basis points, and opex drops by $48M. Savings fund network upgrades and a new self-serve sales channel, lifting ARPU. This is not “magic”; it’s coordinated process change plus AI.

Measurement: making the upside visible

To keep momentum, organizations should publish a living “AI impact P&L” with:

-

Top-line metrics: Conversion lift, cross-sell, time-to-revenue, net retention.

-

Cost metrics: Cycle time reductions, rework rates, error rates, unit economics by channel.

-

Quality and risk: Accuracy, escalation rates, fairness metrics, audit pass rates.

-

Adoption: % workflows AI-assisted, model usage by function, human-in-the-loop acceptance rates.

-

Learning: Experiment throughput, half-life of playbooks (how quickly practices improve).

Transparent measurement builds trust with employees, customers, and regulators, and helps leaders reallocate capital to the highest-return uses.

The compounding effect: AI as a growth flywheel

-

Deploy to high-ROI use cases → near-term profit lift.

-

Reinvest proceeds into data, infrastructure, and skills → better models and broader coverage.

-

Launch AI-native products → new revenue streams with higher margins.

-

Attract talent and ecosystem partners → faster innovation and defensibility.

-

Repeat. Each turn compounds returns, creating a performance gap that late adopters struggle to close.

At scale, this flywheel doesn’t just lift individual firms; it raises sector productivity, moderates inflationary pressures (by lowering unit costs), and expands fiscal capacity through higher tax receipts and lower program costs.

Practical first 100 days for leaders

-

Pick 3–5 needle-movers linked to executive compensation: support resolution rate, inventory turns, claims cycle time, or software release velocity.

-

Stand up an AI council spanning business, technology, legal, and risk; meet weekly.

-

Publish a reference architecture with blessed models, retrieval patterns, tool frameworks, and evaluation protocols.

-

Run controlled pilots with clear baselines and A/B designs, then scale fast on success.

-

Invest in people: offer internal micro-credentials; create “AI champions” in each unit; recognize and reward adoption.

-

Communicate early and often about how AI changes roles and opens growth paths. Clarity reduces fear and speeds adoption.

Conclusion: the size of the prize

The economic upside from AI adoption is massive because it touches the fundamental drivers of prosperity: productivity, innovation, and inclusion. It is not limited to Silicon Valley software firms or to back-office automation. It reaches clinics and classrooms, shop floors and farms, supply chains and city halls. The winners will be those who treat AI as a system-level upgrade—of data, processes, skills, and governance—rather than as a gadget to bolt on. If businesses and policymakers execute with discipline, the result will be faster growth, more resilient services, and new categories of work that are more creative and humane.

The last mile is leadership: deciding that the future of your organization is AI-first, instrumented for learning, and designed for people and machines to excel together. Do that, and the upside won’t just be predicted—it will be realized.

https://bitsofall.com/public-concern-grows-about-ais-social-impact/

AI’s Disruption of the Job Market: What’s Changing, What’s Next, and How to Thrive